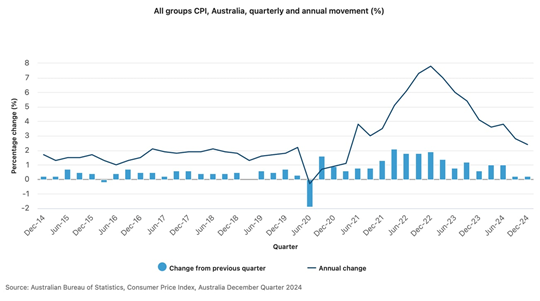

The Reserve Bank of Australia (RBA) has kicked off 2025 with some great news for homeowners. The cash rate has been slashed 0.25 percentage points to 4.10 per cent. The announcement comes after better-than-expected inflation data showed that inflation is heading towards the RBA’s targets.

For those who are looking to buy, today’s announcement may improve your borrowing capacity. Talk to us and we’ll help you explore your finance options. Read today’s official statement on the RBA’s website.

All of the Big Four banks had anticipated today’s decision, and now borrowers will be closely watching lenders to see whether they pass on the cash rate cut.

If passed on in full, it’s estimated borrowers with a $600,000 home loan will save $92 a month, while those with a $750,000 loan will pocket $115 a month.

For a borrower with a $1 million home loan, the cash rate cut is expected to save them around $153 per month.

If you have an existing home loan, it’s important to review your mortgage to see how it stacks up against the competition. While banks generally follow cash rate movements, it’s not guaranteed, so it’s crucial you check your bank’s next move.

Property Market Snapshot

| All dwellings | Auctions / clearance rate | Private sale | Monthly home value change |

| VIC | 761 / 66% | 1124 | ▼ ‑ 0.6% |

| NSW | 924 / 62% | 1633 | ▼ ‑ 0.3% |

| ACT | 63 / 62% | 92 | ▼ ‑ 0.5% |

| QLD | 213 / 41% | 953 | ▲ 0.3% |

| WA | 7 / 29% | 499 | ▲ 0.4% |

| NT | 1 / 100% | 21 | ▲ 0.6% |

| TAS | 2 / — | 157 | 0 |

| SA | 98 / 63% | 256 | ▲ 0.7% |

Need help understanding what this announcement means for you? Contact us today.